Stephen Colbert showed Monday night why his is consistently the top-rated late-night show with a razor-sharp monologue taking on the Oscars fiasco, the progress of the Ukraine war, regime change, Washington politics and, oh, did we mention the Oscars? Seth Myers also had an insightful take on events, as he usually does.

Wednesday, March 30, 2022

Saturday, March 26, 2022

The Physics of Tangling Wires

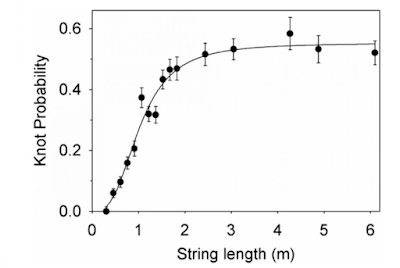

One of the most annoying things with earbuds or any object, for that matter, with wires is how easily they get tangled, even if you neatly coil them before putting them away. Wires almost seem to have a life of their own. Well now physicists, Dorian Raymor and Douglas Smith, at the UC San Diego, explains how. Turns out tangling is "a function of the length of the wire and the amount of 'agitation' the wire is subjected to." Agitation here refers to the induced motion of a material in specified way. The pair published their findings in paper titled Spontaneous knotting of an agitated string. They find that a cord less than 46 cm (about 18 inches) "will almost never tangle itself when sealed inside a rotating box for a period." However, between 50 cm and 200 cm (1.5 to 6.5 feet), the probability of a knot forming rises dramatically. With a cord longer than that, the probability of a knot forming reaches a plateau of 50 percent." Here's what the probability curve looks like:

The article provides a helpful schematic showing how a coiled wire can quickly start to tangle in a rotating box. Rather inconveniently, one end of a cord only has to cross another part of the cord twice to begin spontaneously knotting itself:

So, it's basically a waste of time trying to organize your cords, physics says they'll likely find a way to tangle themselves. To paraphrase mathematician Ian Malcom: wires, uh...find a way.

Thursday, March 24, 2022

Summers to Powell: Do as I Say, Not as I Said

Last Wednesday the Federal Reserve wrapped up its two-day March FOMC meeting and announced a largely expected 25 bp rate hike, the first such action since December 2018. Back then the markets threw a tantrum, dropping 9% on the month, causing the Fed to back off any further actions, because, you know, the 'Fed put.' Beginning with Ayn Rand-devotee Alan Greenspan, Fed Chairpersons have, to a great extent, measured their job performance against the fortunes of the stock market, the most visible, though inaccurate, reflection of the broader economy. But for much of the post-GFC period inflation and economic growth had stayed stubbornly low, and after a while the Fed's highly accommodative policies primarily served to boost financial markets. The only real issue was asset inflation and historic inequality--but, almost by definition, that doesn't matter. Trickle down, right?

Well, things are a little different now, with inflation at a 40-year high, and potentially getting worse. The Fed is in the uncomfortable position of choosing between its favored measured of success, the stock market, and its actual mandate of price stability. But old habits die hard, and the Fed moved gingerly last week with a 0.25% hike and a lot of soothing talk. The markets ripped higher, almost as if laughing at the prospect of the Fed being more aggressive, led curiously by retail investors (?). But being aggressive--a lot more aggressive--may be what's needed, according to Harvard economist Larry Summers. Prior to the FOMC meeting last week, Summers wrote that the Fed needed to hike rates to at least 5% or risk bringing stagflation and recession on the US economy. Following the FOMC's relatively tepid rate move, Summers responded with a stinging Op-Ed in the Washington Post, saying: "The stock market responded positively Wednesday to the Federal Reserve’s move to raise interest rates...I wish I could share that enthusiasm. Instead, I fear, the economic projections of the Federal Open Market Committee (FOMC) represent a continuation of its wishful and delusional thinking of the recent past." Wishful and delusional; tell us what you really think Larry.

Summers' argument stems from what has been a central principle of anti-inflationary monetary policy for decades, namely that to reduce inflation it is necessary to raise real rates. He writes "yet, because of upward revisions in the inflation forecast, the Fed’s predicted real rates have actually declined in recent months. In other words, the FOMC’s plans do not even call for keeping up with the rising inflationary gap. It is hard to see how interest rates that even three years from now will be about 2 percentage points less than current rates of inflation can reasonably be regarded as providing sufficient restraint." He goes on to say "perhaps the FOMC members are wary of pessimistic forecasting. But why shouldn’t they forecast realistically...the credibility of the Federal Reserve is a precious asset. It should not be lightly sacrificed."

Source: St. Louis FRED, MantabyeAnd yet, ironically, Summers may be part of the reason the Fed has been so cautious to begin with. Summers has been successful at reviving the idea of 'secular stagflation' in recent years, which is that demographics, global savings glut, and technology trends are reducing growth and inflation, and the imbalance between savings and investment is pulling down real interest rates. Buttressing the case is what we had seen over the past two dozen years in the U.S. and Europe and perhaps far longer in Japan, at least until the pandemic. Growth has been consistently below expectation, with chronically sluggish demand and low inflation, "just as one would expect in the presence of excess saving. Absent many good new investment opportunities, savings have tended to flow into existing assets, causing asset price inflation." The Fed seemed to buy into that thinking when they persistently described inflation as "transitory." Even after Summers had reversed course in 2021 and warned that continued large scale monetary and fiscal stimulus in response to the pandemic could lead to price instability, many still felt secular stagflation was the bigger risk. In fact, Paul Krugman, quoted Summers to Summers to make the convincing case more stimulus was warranted.

Whether it was the market's response, Summers' comments, or whatever, by Monday the Fed took a much harder tone on rates, with Chair Powell stating, "the labor market is very strong, and inflation is much too high," and that the Fed was open to multiple 50 bps rate hikes and, perhaps, even reducing the Fed balance sheet at the same time. Okay...

Sunday, March 20, 2022

The Race to Buy Chelsea FC

Russian oligarch Roman Abramovich purchased Chelsea FC in 2003 for £140 million (£60 million for the club plus £80 million of debt). His lavish spending in the years that followed led to an era of glittering success for the London club that had previously managed win the league just once in 98 years. Over the past 19 years, Chelsea has won:

- 5 Premier Leagues trophies (only Man U, with 6, has won more over the same period)

- 5 FA Cups

- 3 League Cups

- 2 Europa Leagues

- 2 Champions Leagues (2012, 2021...tied with Liverpool for most wins among English clubs)

Yet for all the club's on-field success, Chelsea never really made any money...by one estimate losing £900 million over Abramovich's reign; not that Abramovich needed it to, or much cared. It bought fame, security...even adoration? But on March 10th, after the UK government imposed sanctions on Abramovich for his ties to the Kremlin following Russia's invasion of Ukraine, Chelsea became a distressed asset. By one report the club's parent company had only cash reserves of £18 million pounds after being cut off from loans made by Abramovich. Moreover, under the sanctions, as long as Abramovich remained the owner, Chelsea could not sell new tickets or even sell merchandise to generate revenue.

So, of course Chelsea is now up for sale...and the good news for fans is that there is a frenzy of bidders for the asset, with some 200 groups showing interest and 30 bids being made. Here's a rundown of the most important groups vying for Chelsea FC:

- Consortium #1

- Todd Boehly, billionaire financier and part-owner of the LA Dodgers. The American wanted to buy Chelsea in 2019.

- Hansjörg Wyss, Swiss billionaire businessman.

- Jonathan Goldstein, British businessman and CEO of Cain International. Doesn't help he's a big Spurs fan.

- Clearlake Capital, $60 billion AuM California-based private equity firm. The firm typically focuses on acquiring tech companies, but sure, why not?

- Consortium #2

- The Ricketts family, owners of the Chicago Cubs. Wanted to buy Chelsea in 2018. Winning MLB's World Series to translate into EPL titles? I dunno, feels Chelsea could have its own Ted Lasso season.

- Ken Griffin, founder and CEO of the massive hedge fund Citadel. He's worth $26 billion, so money isn't an issue. But Ted Lasso, he's not.

- Consortium #3

- Martin Broughton, a former chairman of British Airways and big Chelsea fan. Actual experience running a football club, albeit briefly, as Chairman of Liverpool in 2010.

- Lord Sebastian Coe, famed British runner, former Conservative MP, and president of World Athletics. Adds heft, political connections, and some pedigree for the class conscious.

- Woody Johnson

- Heir to the Johnson & Johnson fortune, former U.S. ambassador to the UK under Trump, and owner of the NY Jets...yeah, no shot.

- Consortium #4

- Nick Candy, British real estate mogul and big Chelsea fan. Promised to put a fan on the board! Mr. Popular.

- South Korea’s Hana Financial Group

- C&P Sports Group

- Saudi Media Company

- Helmed by billionaire Saudi businessman Mohamed Alkhereiji, who is said to be a huge Chelsea fan. Not to be confused with the Saudi government who own Newcastle.

- Aethel Partners

- Global private equity firm headquartered in London.

Monday, March 14, 2022

Ronaldo Hat-trick Inspires Brady?

What a weekend of football news! First, Ronaldo scored a superb hat-trick at Old Trafford to become the highest goal scorer in football history! Tom Brady watches from the stands and 24 hours later announces he is coming out of retirement for his 23rd NFL season! Why not? If at 37 (basically 50 in NFL years) Ronaldo can still dazzle, then why can't Brady at 45? After all, he was almost MVP last season.

Ronaldo's best game of the year for Manchester United saw him score three excellent goals against the Spurs. Ronaldo's 805th, 806th, and 807th career goals saw him become FIFA's all-time goal scorer, edging past Austrian marksman Josef Bican who held the record for 80 years. Each goal was different from the other, aptly showcasing the range of talent that makes Ronaldo such a prolific scorer. The first was a swerving strike from 25 meters out. The next was a classic striker's goal, with Ronaldo deftly redirecting a cross in-front of goal. The third was a powerful header late in the 83rd minute to clinch an exciting 3-2 victory against the Spurs. The win pushed Man U into the fourth place in the EPL and kept them in the running for a place in Europe next season.

Well, in the stands was another football record holder.

Thursday, March 10, 2022

Viva Benzema: Hat-trick Sinks PSG

Real Madrid knocked out Paris St. Germain in the Champion's League Thursday night at the Bernabeu after going down 0-2 in aggregate. After a first half dominated by (future Madridista?) Kylian Mbappe, PSG once more let the advantage slip, as Karim Benzema rifled home three quick goals to seal an unlikely comeback.

Sunday, March 6, 2022

Share Warne Dead at 52

Australian cricket legend Shane Warne died Friday of a suspected heart attack. He was just 52. Warne is widely acknowledged to be one of the, if not the, best bowlers the game has ever produced. He revived the lost art of leg-spin bowling which had lost ground to hard-charging fast-bowlers in the 1970s and 1980s. Warne played in 145 Test matches and 194 ODIs for Australia between 1992 and 2007. He took 708 Test wickets and 293 one-day wickets with a 25.4 and 25.7 bowling average, respectively. He was also handy with the bat...his full stats are here. A larger-than-life character, occasionally embroiled in controversy, Warne helped Australia win the 1999 cricket World Cup. He will receive a state funeral.

Shane Warne bowled over 50,000 balls in his illustrious international cricket career, but none may have been better, or certainly as famous, as his "ball-of-century" that completely bamboozled Mike Gatting in the 1993 Ashes series against heated rivals England:

Carlos Supreme: Alcaraz Achieves Career Grand Slam

On Sunday, Carlos Alcaraz made history when he became the youngest man ever to complete a career Grand Slam after defeating Novak Djokovic ...

-

This is more a discussion than a "debate" between two giants of the economics profession. Both are Democrats and agree on the basi...

-

Russian oligarch Roman Abramovich purchased Chelsea FC in 2003 for £140 million (£60 million for the club plus £80 million of debt). His la...

-

Even though many of us are still working from home and days of the week can sometimes meld into one another, the weekend still seems to (and...